PRODUCTS

Wire Mesh Plywood

Shelf Plate

Red film faced plywood

PVC Plywood

PVC Plywood

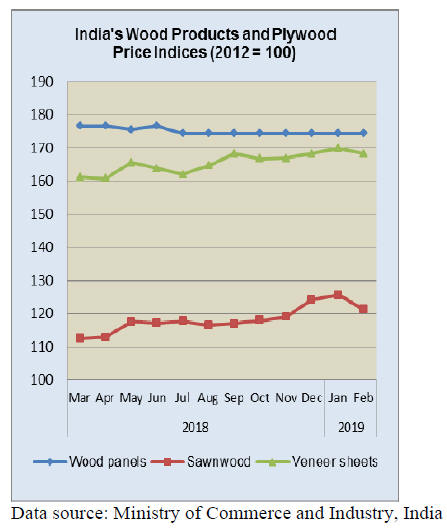

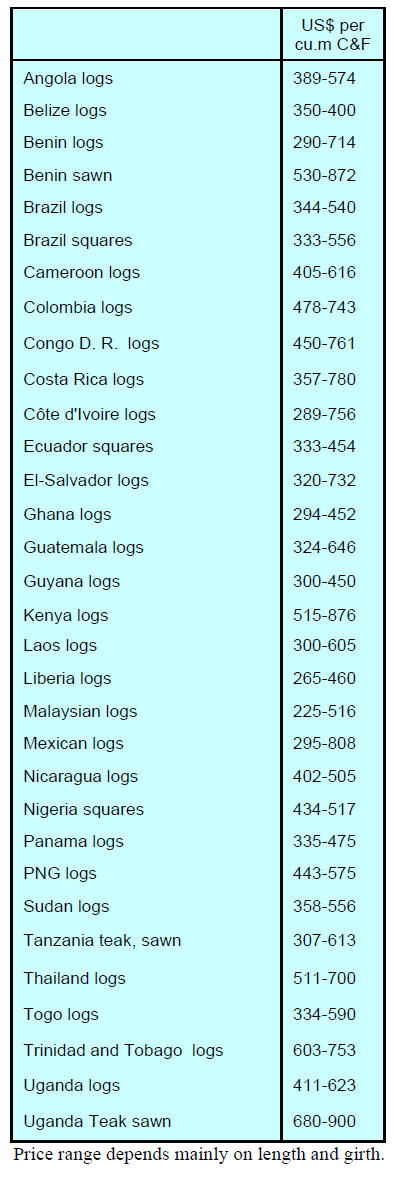

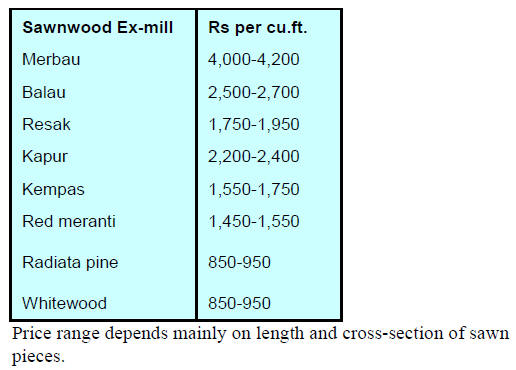

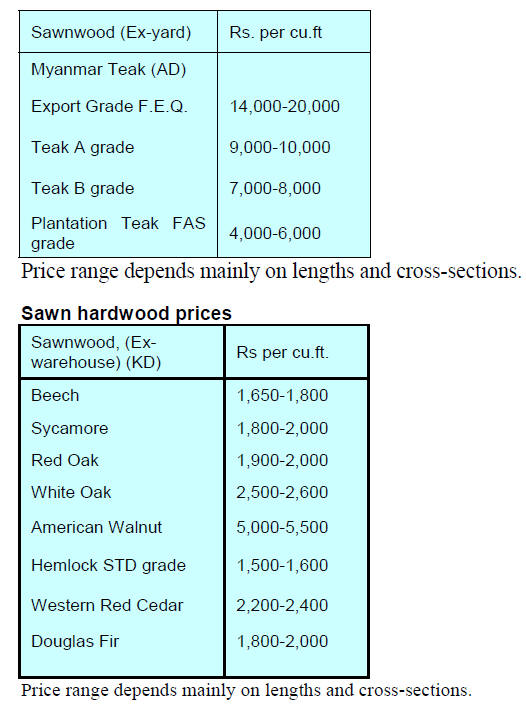

Brown film faced plywood

Pine Plywood

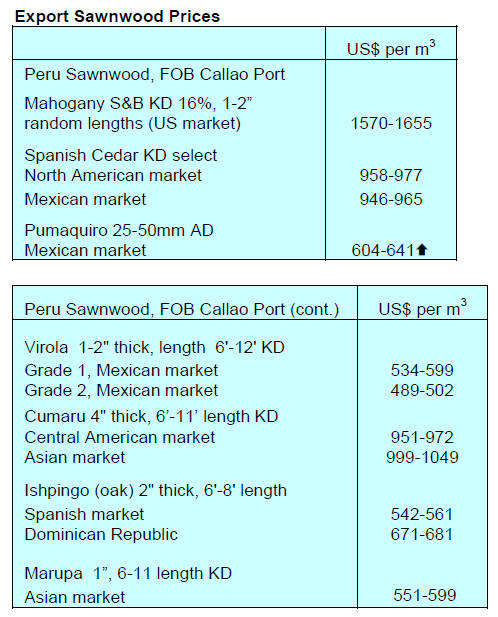

Finger Jointed Board-Pine

Container Flooring Plywood

Bending Plywood

UV Birch Plywood

Pine Plywood

Melamine Plywood

Polyester Plywood

Teak Plywood

Sapeli Plywood

Red Oak Plywood

Cherry Plywood

Slotted MDF Board

Solid Chipboard

Tubular Chipboard

Plain MDF

OSB

Melamine Laminated MDF

White Primer Door

White primer doorskin

Teak veneered doorskin

Sapeli veneered doorskin

Red Oak veneered doorskin

Plain HDF/MDF Doorskin

NEWS

International plywood & veneer prices

Time:2019-06-08

clicks:0

|

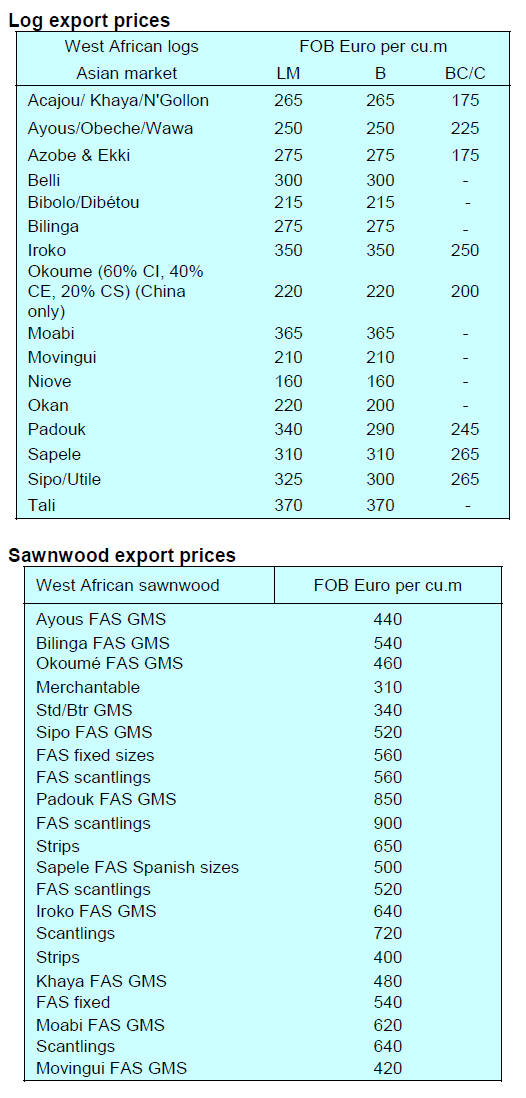

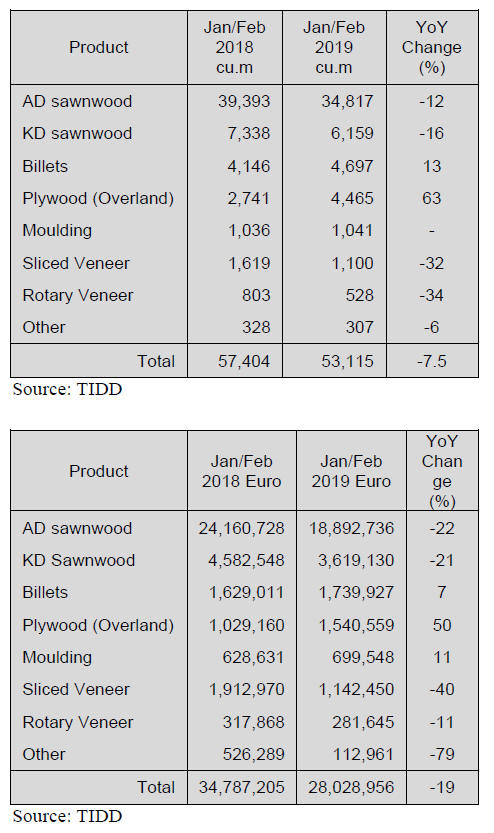

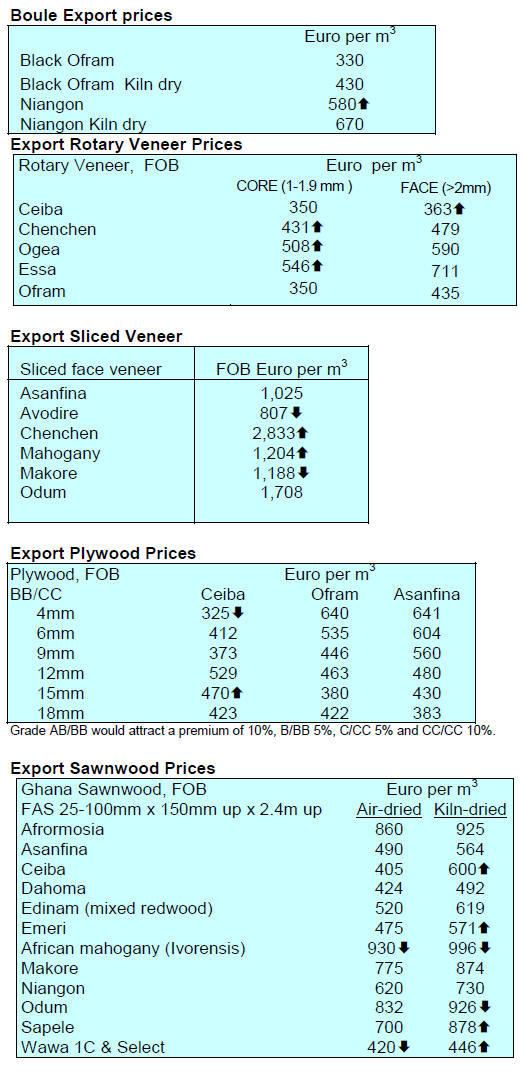

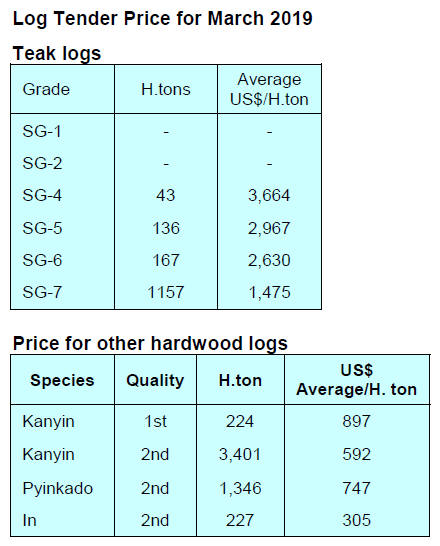

The Forest Authority in Gabon has reportedly suspended the logging license held by Chinese company following revelations of breaches of forestry laws. This follows an investigation ordered by the Forestry and Environment Minister, Guy Bertrand Mapangou. In a statement the ministry said investigators had concluded that the company had been illegally harvesting in two locations. Growing shipping opportunities in the region The Danish shipping company NORDEN will open an office in Abidjan, Ivory Coast,to generate new business. This new office will be NORDEN’s 11th office. The company says “As West Africa is a promising region for shipping business, NORDEN sees growing opportunities within dry cargo and is the regional hub connecting French-speaking Africa and the home to many major institutions working across Africa, Abidjan is a natural location for NORDEN’s new office.” European and Middle Eastern markets stable Producers have not reported any major price movements up to mid-April. Demand in European and other western markets is stable and stock levels are being maintained. The trade is anticipating some major shifts in price structures and product sales as several countries in the region are about to implement new policies for the forestry and timber sector. Drastic reduction in harvesting in Congo The immediate effect of the log export ban in Congo Brazzaville has been a drastic reduction in harvesting operations and this has led to massive worker lay-offs say analysts. Authorities in Gabon crack down The forest authorities in Gabon have launched a campaign to crack-down on companies that allow infringements of the regulations. Currently some companies have been stuck with huge fines for misreporting the species and volumes being exported. Chinese operators relocating The closure of Chinese mills in Gabon has resulted in an increase in investment in Congo as mills have relocated and begun operation often under a new name. It is reported that company officials arrested for kevazingo export violations have been released in order to restart operations and pay workers.  2. GHANA Wood exports dip Wood product exports in the first two-months of 2019 dropped 7.5% in volume and 19% in value (Euro terms) year on year according to the Timber Industry Development Division (TIDD). The cumulative volume and value figures for the first two months were 53,115 cu.m and Euro 28.03 million compared to 57,404 cu.m and Euro 34.88 million over the same period 2018.  Sawnwood (AD and KD) were the leading export products in both 2018 and 2019. These two products contributed 40,976 cu.m to total exports representing 77% of the 2019 export volume. Billet exports expanded 13% to a volume of 4,697 cu.m in the first two months of 2019 from 4,146 cu.m in 2018. This roundwood was mainly exported to India. In previous years Ghana’s plywood exports went to regional and other international markets but for this year a volume of 4,465 cu.m was all shipped overland to regional markets to which there was a 63% rise in export volumes. Regional markets include Burkina Faso, Niger, Benin, Nigeria and Togo. Protecting Volta Lake The Forestry Commission (FC) and the Volta River Authority (VRA) will work together to plant bamboo to protect the catchment of the Volta Lake, which is home to the Akosombo hydro-electric Dam. Under a project titled: “Bamboo for the Protection of the Volta Lake”, the two institutions would collaborate to fight deforestation as a result of livelihood enhancement activities in the catchment areas of the Lake including the gorge which has the dam. Bamboo and rattan constitute the two largest non-timber forest products in Ghana. The FC has established a bamboo and rattan unit to promote the sustainable development and utilisation of these resources. Double taxation deal The Government has signed double taxation agreements with Belgium, Denmark, France, the United Kingdom, Switzerland, Mauritius, South Africa, Italy, Netherlands and Germany. Eric Mensah, the Assistant Commissioner in charge of Legal Affairs and Treaties at the Ghana Revenue Authority said the agreements aim at eliminating juridical or economic double taxation.  3. MALAYSIA Plantation expansion in Sabah to get Federal help Primary Industries Minister, Teresa Kok, said the Federal government will assist Sabah in its reforestation efforts. She said her ministry and the Sabah Forestry Department have identified a site in the east coast for part of the reforestation programme. In advance, the two agencies will undertake a wildlife survey in the area proposed for plantation development. She also referred to the Federal government’s decision to limit further oil palm cultivation and to ban the conversion of forest land for oil palm cultivation as well as a ban on planting oil palm on peatland. Revised Pahang tax levels to stay say Chief Minister The Pahang Chief Minister, Wan Rosdy Wan Ismail, said Pahang state has no intention of lowering its timber tax which was raised in June last year. The Chief Minister said the latest increase was the first for 31 years and was considered reasonable and is lower than in some other states. Perak, Terengganu and Kelantan have raised their tax rates three or four times over the same period. The tax increase will raise State income from timber to around RM200 million from RM100 million. Timber sector wants to be included in foreign worker regularisation programme The Sabah Timber Industries Association (STIA) has indicated it hopes that the state government will consider applying the ‘Regularisation Programme’ for illegal foreign workers in the plantation and agricultural sectors to all sectors in Sabah, particularly wood-based manufacturing. STIA President, Chua Yeong Perng, said the conditions of the new regulation should be applied to all so that employers in other sectors have the same benefits as plantation and agriculture sectors. STIA welcomed the decision of the Government to require the Immigration Department to introduce the new rules. Chua said local manufacturers in the wood-based sector cannot attract local workers and that the level of automation in the industry is still very low. Tallest tropical tree Scientists in the UK and Malaysia reported they have discovered the world's tallest tropical tree measuring more than 100m (328ft) high. The yellow meranti was found in Sabah by a team from the University of Nottingham last year. https://www.nationalgeographic.com/environment/2019/04/worl ds-tallest-tropical-tree-discovered-climbed-borneo/ Sarawak timber sector suffering reduced margins Sarawak timber companies are seeing margins decline because of higher production costs of logging and the introduction of new tax structures in the timber sector. According to the Sarawak Timber Association (STA) the increase in hill timber rehabilitation and development cess (tax), at RM55 per cu m has pushed up operating costs significantly. In addition, rising wages, reduced harvest levels and implementation of forest management certification scheme had contributed to the current high cost of production. By 2022, the Sarawak Forest Department wants all longterm forest timber licensees to achieve forest management certification to ensure sustainable management. Against this background the STA said the state forest industry is going through a period of transformation and a change from raw material supply from natural forests to supply from planted forests. Bintulu Port expansion planned Bintulu Port plans to expand capacity at its Bintulu International Container Terminal (BICT) to cope with rising demand. There has been a double-digit growth in container throughput for three consecutive years. The BICT handled 349,792 TEUs (twenty-foot equivalent unit) last year, representing a 13% growth over 2017 and the highest ever traffic according to Mohammad Medan Abdullah the Bintulu Port chief executive. A feasibility study on the expansion is currently under way. 4. INDONESIA Indonesia and UK discuss trade agreement anticipating Brexit Indonesia and the UK are beginning discussions on bilateral cooperation in anticipation of the UK leaving the European Union. Dino Kusnadi, Director (Europe) in Indonesian Ministry of Foreign Affairs said that one of the trade agreements being explored was for timber traded under the FLEGT-VPA between the EU and Indonesia. Soewarni, the Chairman Indonesia Sawmill and Wood Working Association (ISWA), welcomed the government's move to expand timber and wood products trade with UK as this could boost exports of wood products. See: https://ekonomi.bisnis.com/read/20190401/99/906829/asosiasikayu- olahan-siap-optimalkan-pasar-inggris APKINDO seeks unified tariffs for meranti/seraya plywood The plywood industry has complained that import duties for Indonesian and Malayasian wood products in the EU should be unified. Gunawan Salim, Marketing and International Relations Executive in the Indonesian Wood Panel Association (Apkindo) said the issue of import duty differences between meranti plywood from Indonesia and seraya plywood from Malaysia to the EU needs to be addressed as Indonesian exporters are at a disadvantage. He stated that the import duty on meranti plywood from Indonesia is 7%, while the import duty on seraya plywood from Malaysia is 3.5%. Gunawan explained that these two names are commercial names for the same timber. See: https://ekonomi.bisnis.com/read/20190401/99/906911/flegtvpa- lebih-efektif-bila-bea-masuk-sama Furniture industry – please relax regulations Indonesian furniture entrepreneurs have asked the government to relax a number of rules affecting production of processed wood saying the Ministry of Trade Regulation No. 110/2018 concerning imports without a Limited Prohibition (Lartas) license and SVLK implementation are some rules that need to be revised. Trade Ministry Regulation 110/2018 regulates imports and this is a problem say manufacturers. If the regulation was removed, furniture entrepreneurs could more easily obtain production materials and would not have to wait for permits to be approved for the import of accessories used in furniture production. In addition, the implementation of SVLK to downstream industries hampers the performance of furniture sector. The certificate should only be applied to the upstream industry as it is intended to prevent illegal logging. China’s domestic furniture consumption an opportunity for Indonesia Abdul Sobur, Secretary General of the Indonesian Furniture and Handicraft Industry Association (HIMKI), has projected that furniture consumption in China could reach US$225 billion annually and this represents an opportunity for Indonesian exporters if they are smart. He said a product that can be immediately promoted for the Chinese consumer is rattan furniture, a segment where Indonesia has an advantage. In addition to exporting to China the furniture industry should also seek cooperation with Chinese enterprises to invest in the country. See: https://ekonomi.bisnis.com/read/20190408/257/909172/chinajadi- pasar-mebel-terbesar-dunia#  5. MYANMAR Anti-Corruption measures highlighted In 2018, the Myanmar parliament enacted a tough forest law that threatens violators with up to 15 years in prison in a bid to conserve the country’s fast-dwindling forest resources. Under the new law, which was enacted on September 20 2018, forestry staff can also be punished for accepting bribes or for being involved in the extraction, transfer or possession of illegally harvested logs or forest products. U Nyi Nyi Kyaw, Director General of the Forest Department under the Ministry of Natural Resources and Environmental Conservation, said an education campaign would be conducted to inform the public on the new law. Union Minister for Natural Resources and Environmental Conservation U Ohn Win called for greater efforts to eliminate corruption in the country’s forestry sector. FDI on the rise after 2 year slump According to Myanmar Investment Commission (MIC) the flow of foreign investment into Myanmar has started to rise after declining for the past two years. Between October 2018 and March 2019, Myanmar received US$1.9 billion in approved FDI. During the period October 2017 to March 2018 the equivalent number was US$1.3 billion for over 80 projects. Singapore has overtaken China as the major investor in Myanmar. In February last year, Singapore invested US$20.88 million for 302 projects and China invested $20.41 million for 314 projects, according to DICA figures. Myanmar is attracting more investment spurred by the new Myanmar Investment Promotion Plan and establishing a new ministry, the Ministry of Investment and Foreign Economic Relations with the objective of raising local and foreign investments and creating opportunities for entrepreneurs. A UN-mandated Fact-finding Mission on Myanmar (UNFFM) recommended that all business enterprises active in Myanmar, trading with or investing in businesses in Myanmar should demonstrably ensure that their operations are compliant with the United Nations Guiding Principles on Business and Human Rights (UNGPs).  6. INDIA Higher particleboard prices lifts price index The official Wholesale Price Index for ‘All Commodities’ (Base: 2011-12=100) for the month of February, 2019 rose to 119.5 from 119.2 for the previous month. The index for manufactured wood and cork products rose due to higher prices for particleboard. However, prices for sawnwood dropped pushing down the index. The annual rate of inflation based on monthly WPI in February 2019 stood at 2.93% compared to 2.76% for January. The press release from the Ministry of Commerce and Industry can be found at: http://eaindustry.nic.in/cmonthly.pdf  India not a DIY country - IKEA changes business format The online retailer IKEA is changing its business model to suit the market as India is not a DIY market but rather a serviced market. IKEA will open mall style retail outlets and will address servicing by teaming up with Indian companies. The Swedish retail firm has been clear that it sees India as a long-term market and has made significant investments in the country. The Indian retail industry is expected to grow to US$1.1 trillion by 2020 according to a report by Deloitte and the Retailers Association of India. Gloomy prospects for home prices According to a recent report by Liases Foras, a Mumbaibased housing research company, because home sales are unlikely to improve in the short term, construction companies are finding it difficult to escape the debt trap they are in as they cannot service their debt obligations because of low sales and high inventory. https://www.liasesforas.com/ In recent years access to credit and funding has become a major problem for builders as the advances on homes from buyers and financing from investors is insufficient to service loans. This problem has been made worse since the Reserve Bank of India (RBI) changed its guidelines to banks on the risks associated with loans to builders which resulted in banks offering less support to the sector. According to a report from Liases Fores there is a housing inventory of about 41 months in the top eight cities in India and this has created a crisis for developers. Plantation teak prices The Rupee continues to firm against the dollar bringing cheer to importers. Traders still anticipate further strengthening of the Rupee. Analysts report that demand for imported plantation teak is firm and recent delivers have been of good quality especially those from South American and African shippers. C&F prices for plantation teak landed at Indian ports are within the same range as shown in the previous report.  Locally sawn hardwood prices Prices for imported sawn hardwoods remain unchanged.  Myanmar teak prices The pace of import growth from Myanmar is being sustained but demand is getting ahead of supply say analysts. The importers in India are appealing for greater output and exports from Myanmar. Middle East demand for teak products from India is weakening as importers there have switched to iroko as a good substitute for Myanmar teak. Prices continue as previously reported.  Indian importers are showing more and more interest in hardwoods from the US, Canada and some European countries such as Finland and Sweden. This is helping to stimulate demand as buyers have wider range of timbers to choose from. Indicative prices for some imported timbers are shown above. Increased capacity pushing up plywood log prices Situation in the plywood sector is unsettled at the moment. Many new manufacturing licenses have been offered in various states such that production capacity has risen significantly without a corresponding increase in demand. There has been a rise in the log raw material price and mills seek logs to sustain output and this, along with a shortage of labour and supervisory staff is testing the profitability of manufacturers which has resulted in plywood prices being increased. But whether the new prices can be sustained is questionable as demand is not expanding. Manufacturers have raised prices by about 10%. Plants in Gabon continue to ship veneer to India. Production is increasing as more Indian companies invest in veneer production in Gabon.  7. BRAZIL Rising log demand for export production Against the background theme of "Forests and Log Market", a workshop, arranged by the Brazilian Agricultural Research Corporation (EMBRAPA) and the Paraná State Forest Based Companies Association (APRE), concluded that there has been a sustained rise in demand for logs for domestic processing. Demand for roundwood is high despite the low level of domestic economic growth and this is because more companies are exporting. Log consumption is estimated at around 14 million cu.m annually. Most log consumers are vertically integrated but also purchase between 30% and 40% from the open market. Participants at the workshop reported some problems with supply as logs have become of smaller diameter and transport distance are rising. Paraná and Santa Catarina states have expanded eucalyptus plantations by 190,000 hectares because of demand from forestry companies that prefer eucalyptus which offers shorter rotations and increased yields comaperd to pine. Increasing planted forests areas The National Forest Development Plan prepared by the Brazilian Agricultural Research Corporation (Embrapa Florestas) aims at a 20% increase in the area of planted forest to achieve a national target of 20 million hectares of commercial forests by 2030. Currently, according to the Brazilian Tree Industry (IBA), the planted forest area is 7.8 million hectares of mainly eucalyptus, pine and acacia. The area with planted forests occupies only 1% of the national territory but accounts for 91% of all wood produced for industrial purposes. The planted forest productivity averages of 35.7 cu.m/ha./year. New measures from the Brazilian Forest Service and the National Plan for Development of Planted Forests (known as PlantarFlorestas) were discussed at a recent meeting of the Production Chain of Planted Forests at the Ministry of Agriculture, Livestock and Food Supply (MAPA). One issue raised was the need to preserve and protect natural vegetation in some 5.6 million hectares of natural forests under private ownership. 2019 Furniture Fair BtoB events yield results An “International Buyer Project” has been developed by the Brazilian Furniture Industry Association (ABIMÓVEL) and the Brazilian Trade and Investment Promotion Agency (APEX - Brazil) and this was introduced at the 2019 Furniture Fair (Movelpar) arranged with the support of the Union of Furniture Industries of Arapongas (SIMA) and EXPOARA. Movelpar brought together 60 Brazilian industries and 30 importers from 11 countries including North America and the Middle East to build business and commercial partnerships. According to ABIMÓVEL, 740 business rounds were held of which 60% were new commercial contacts between Brazilians and international buyers. The projections are of orders for US$13.6 million of Brazilian products. So far this year two events under the International Buyer Project have already been carried out by ABIMÓVEL and APEX-BRASIL. Exports increase from in São Bento do Sul In 2018 a furniture industrial center in São Bento do Sul municipality, in Santa Catarina State, one of the main furniture export regions, registered an increase in exports. 2018 export revenues from industries in São Bento do Sul, Campo Alegre and Rio Negrinho region reached US$165 million, up 30% compared to 2017. São Bento do Sul is a top Brazilian municipality for furniture exports with a 16% share of national exports. Export revenues in the region represented 58% of the total furniture exports from Santa Catarina State and 23% of the national total. The country's furniture industries exported US$723 million, up 9.9% over the previous year and Santa Catarina state US$283 million, up 19.5. According to the Union of Construction and Furniture Industries of São Bento do Sul (SINDUSMOBIL) export growth was mainly driven by two factors; the exchange rate has been favourable to exports and over the last few years more companies started to export because of weak domestic market.   8. PERU Responsible utilisation the key to sustainability During a recent Spain/Peru Business Meeting, Erik Fischer, Vice president of the Association of Exporters (ADEX), emphasised the economic strengths of the country and the Government's commitment to further development of the forestry and timber sectors as a new driver of growth. Fischer commented that the development of forest plantations and the responsible and sustainable use of Peru’s extensive natural forests can be effectively managed through closely monitored forest concession models. Fischer pointed out that it has been observed by several agencies that most of the deforestation in Peru is due to shifting agricultue which is not sustainable. January exports at new high According to ADEX, January 2019 exports of Peruvian wood products totalled US$11 million FOB. This compares to the US$7.1 million exports in January 2018. Of the US$11 million exported in January 2019, China was the main destination with a 34% share but demand in China has fallen sharply (-60%) compared to 2018. France was the second placed market with 15% share. Sawnwood exports in January this year were US$1.9 million FOB, up 4.3% on the previous year. The main destination for export sawnwood was the Dominican Republic with a 32.4% share; second was Mexico followed by China. SERFOR and WWF cooperation in promoting SFM The National Forestry and Wildlife Service (SERFOR) of the Ministry of Agriculture and Irrigation and WWF Peru have signed an agreement for cooperation in promoting mechanisms for sustainable management of forests and wildlife in Peru. This cooperation will strengthen coordination of work between both institutions with the aim of contributing to scientific research, promoting the restoration of degraded landscapes, supporting the development of local capacities and promoting the management and sustainable use of flora and fauna resources, through alliances with our indigenous people and other stakeholders. Transport control system improved In order to improve the supervision and control of the Forest Transport Guides (GTF) the National Forestry and Wildlife Service (SERFOR) has introduced a computer application that will improve the tracking of wood from its origin to mill gate. The tool is called the ‘Application for the Issuance and Registration of GTF’ and the system is compatible with cell phones and tablets and has been tested in the departments of Madre de Dios, Puno, Arequipa and Lima (Pucusana) whose Regional Forestry and Wildlife Authorities (ARFFS) and Technical Forestry and Wildlife Administrations (ATFFS) have been trained. With this system, it will be possible to track the transport of the wood in real-time and recover data on the type of product, the volumes, the species, the destination and transport used and the point extraction.   |

|

皖公网安备 34011102001010号

皖公网安备 34011102001010号